Browse our library of identity & business verifications

Customize your AI Agent with the compliance checks that fit your workflow.

Perform checks to screen customers against adverse media, sanctions lists, politically exposed persons (PEP) databases, and state-owned entity registries to identify high-risk individuals and organizations for anti-money laundering compliance.

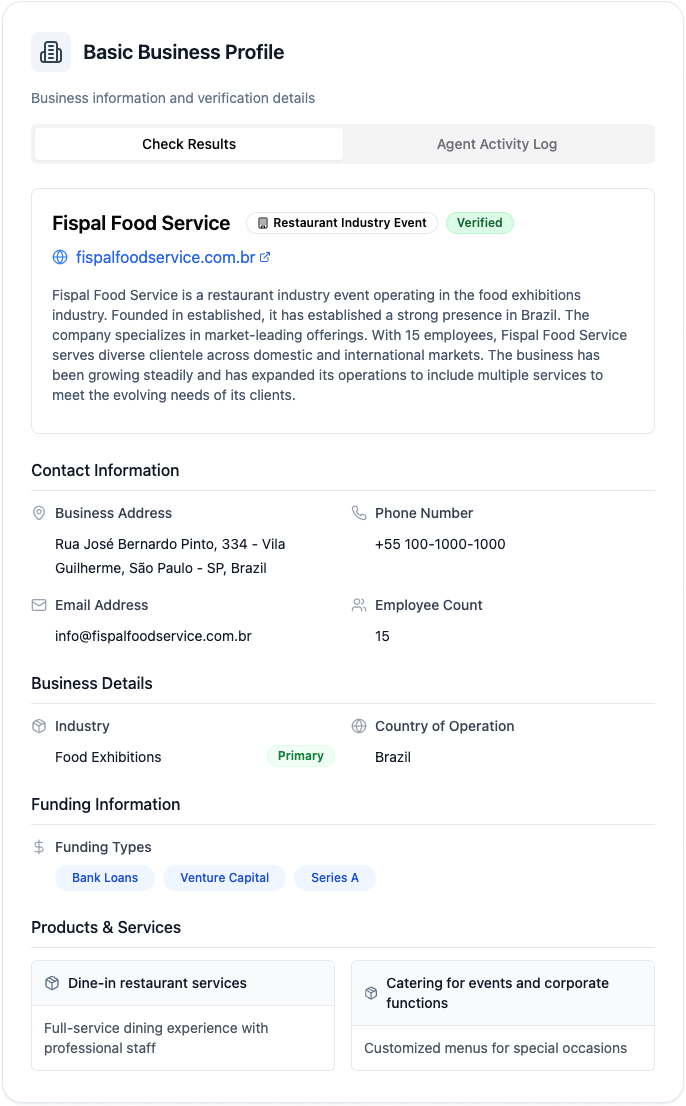

Verify basic business information by comparing self-attested data against web research findings. Automatically validates business name, registration, industry classification, and operating status to ensure authenticity.

Instant verification of business authenticity using comprehensive web research

Automated comparison of self-reported data against publicly available information

Real-time detection of discrepancies in business registration and operational details

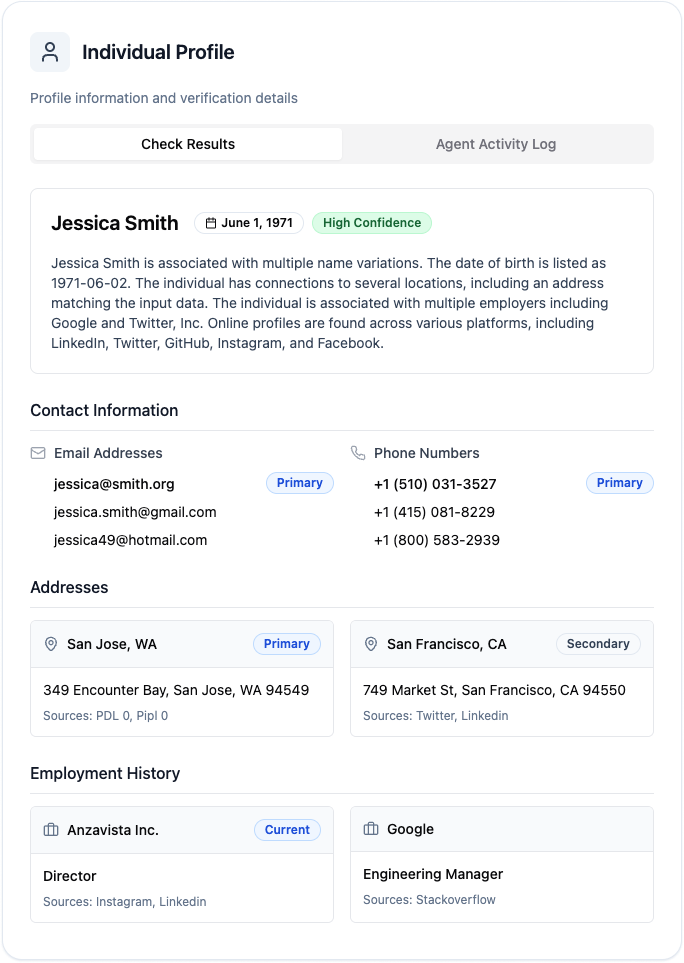

Deep due diligence on individuals to identify information that can be used to discount alerts e.g. employment history, address history, social media accounts

Enrichment from multiple sources to identify addresses, social media, next of kin and more

Open-source intelligence gathering across multiple criteria like employment, property ownership, business ownership

Advanced matching capabilities to distinguish between individivuals with the same name

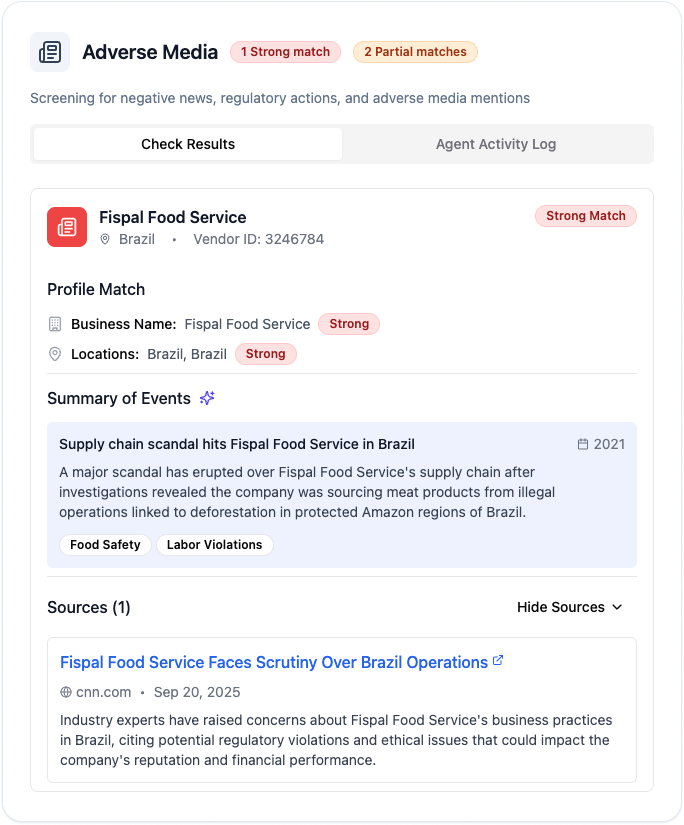

Identify potential business risks by analyzing news articles, media coverage, and customer reviews across multiple sources. Automatically screens for negative coverage, regulatory investigations, legal proceedings, and reputational issues.

Comprehensive media monitoring across global news sources and review platforms

Instant detection of regulatory investigations, legal proceedings, and compliance issues

Automated risk assessment with detailed source documentation for audit trails

Screen individuals and businesses against global sanctions lists including OFAC, UN, EU, and HMT databases. Automatically validates against all major sanctions databases with real-time updates and intelligent matching algorithms.

Real-time screening against OFAC, UN, EU, and HMT sanctions databases

Intelligent matching algorithms reducing false positives while ensuring compliance

Automated sanctions monitoring with instant alerts for list updates

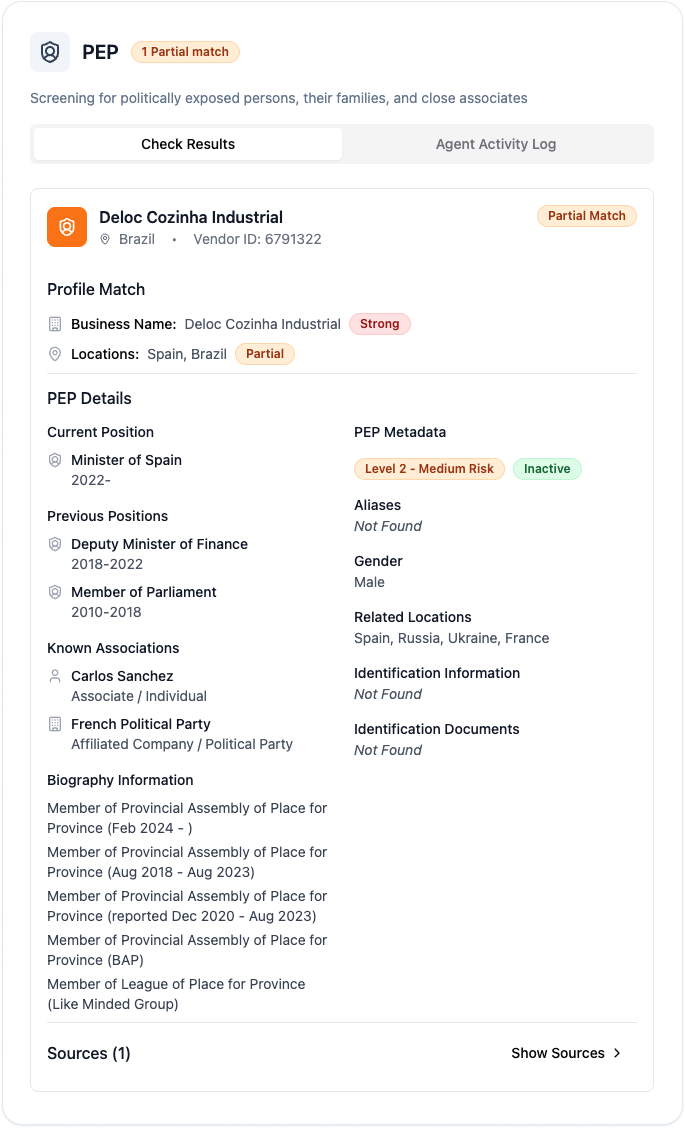

Identify Politically Exposed Persons (PEPs) and their associates through comprehensive database screening and risk assessment. Automatically screens against global PEP databases with intelligent context analysis to reduce false positives.

Comprehensive PEP screening against global databases and watchlists

Intelligent context analysis reducing false positives by 90%

Automated risk assessment with detailed PEP profile documentation

Customize your AI Agent with the compliance checks that fit your workflow.

Our AI Agents are integrated with multiple global data providers, operate in any language and are customizable to meet the requirements of any jurisdictions where you operate.

Parcha AI agents consistently achieve 95-99.7% accuracy across all verification types, significantly outperforming manual processes. Our accuracy rates are validated by real customer deployments like Flutterwave, which achieved 99.7% accuracy in production.

Parcha uses intelligent context analysis, cross-referencing screening hits against verified web presence and career history. This reduces false positives by 90% while maintaining 100% detection of genuine risks through comprehensive validation.

Parcha screens against all major databases including OFAC, UN, EU, HMT sanctions lists, plus comprehensive PEP databases and global adverse media sources. We continuously update our database coverage as new sources become available.

Most verification processes complete in 2-5 minutes, compared to 20-120 minutes for manual processes. Simple checks like business profiles complete in under 30 seconds, while comprehensive due diligence takes 2-3 hours instead of 24+ hours manually.

Yes, Parcha is SOC 2 compliant with enterprise-grade security. All data is encrypted in transit and at rest, we maintain comprehensive audit logs, and we never store sensitive data longer than necessary for processing.

Parcha is built with enterprise-grade security, privacy and compliance. We put guardrails and limitations on AI to make sure you are always in control.

Parcha is SOC 2 Type 2 compliant as evaluated by a third-party security auditor

Each customer gets a private instance with SSO and granular access controls.

You are always in control of how AI is used to carry out each step in your compliance workflow

Choose and customize your AI agents

Connect your compliance data

Deploy and start reviewing instantly

See all our use cases here

Give your customers AI agents to remain compliant with your program without slowing down their ambitions

Speed up your underwriting pipeline with AI-powered business due diligence, screening and document extraction.

Get your customers onchain faster, while mitigating risks and remaining compliant with our end-to-end AI-powered KYB/KYC solution.

Every customer counts in today’s market. Approve and activate more customers faster with AI-powered KYB/KYC automation that will process and remediate manual review cases 10X faster than your operations team.